Accounting Made Simple: Summary Review & Takeaway Points

This is a summary review of Accounting Made Simple containing key details about the book.

What is Accounting Made Simple About?

Accounting Made Simple is a guide to basic accounting. Written with business app development in mind, the author discusses some of the most common accounting processes, including assets, multiple accounts, journaling, posting, inventory, and payroll.

Here's what one of the prominent reviewers had to say about the book: "Very simple book on the basic fundamentals of accountng. Short, easy introduction to the topic that's easy to digest. It allows to get an overview of the subject and will prime you for anything more in-depth to follow." - LibraryThing 👍

Who is the author of Accounting Made Simple?

Mike Piper is the author of several personal finance books and the popular blog Oblivious Investor.

Favorite Quote: “The benefit of the additional accounting accuracy is far outweighed by the hassle involved in making insignificant depreciation journal entries year after year.” ― Accounting Made Simple Quotes, Mike Piper

Book Details

- Print length: 114 pages

- Genre: Business, Finance, Accounting

What are the main summary points of Accounting Made Simple?

Here are some key summary points from Accounting Made Simple:

- Takeaway 1: An accounting equation measures how healthy your finances are: Assets = Liabilities - Equity. Or, if you want to know your equity, or how much you truly own/have: Assets - Liabilities = Equity

- Takeaway 2: The balance sheet is the complete list of assets, liabilities, and equity and outlines your personal or company's financial health

- Takeaway 3: An income statement tracks financial performance over time, usually a financial year or quarter, and outlines total income after subtracting total expenses from gross profit.

- Takeaway 4: The cash flow statement records outflow and inflow of cash and differs from an income statement by outlining a company's financial health in current circumstances, not over a set time period. It combines operating activities, investing activities, and financing activities to check for positive or negative cash flow.

- Takeaway 5: Ratios are used to analyse the above statements. They are a fast way of knowing whether your company or business is running efficiently and is profitable.

- Takeaway 6: Accountants use a double-entry data system to record financial activity. If you were to buy a desk for $200, you would record that as -$200 in your personal bank account. But, accountants would record that as both a debit and a credit - $200+ in assets and - $200 in cash. All of these are recorded in the general ledger, which is used to create financial statements.

Accounting Made Simple Chapters

Chapter 1: Accounting Equation

Chapter 2: Balance Sheet

Chapter 3: Income Statement

Chapter 4: Statement of Retained Earnings

Chapter 5: Cash Flow Statement

Chapter 6: Financial Ratio

Chapter 7: What is GAAP?

Chapter 8: Debits and Credits

Chapter 9: Cash vs. Accrual

Chapter 10: The Accounting Close Process

Chapter 11: Other GAAP Concepts & Assumptions

Chapter 12: Depreciation of Fixed Assest

Chapter 13: Amortization of Intangible Assests

Chapter 14: Inventroy & CoGS

(* The editor of this summary review made every effort to maintain information accuracy, including any published quotes, chapters, or takeaways. If you want to enhance your personal growth, I recommend checking out my list of favorite personal growth books. These books have played a significant role in my life, and each one includes a summary and takeaways to help you apply the concepts.)

Chief Editor

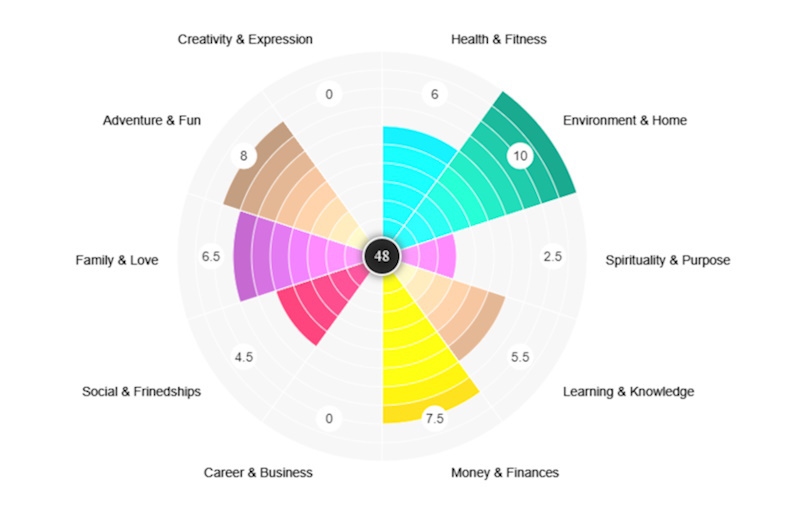

Tal Gur is an author, founder, and impact-driven entrepreneur at heart. After trading his daily grind for a life of his own daring design, he spent a decade pursuing 100 major life goals around the globe. His journey and most recent book, The Art of Fully Living, has led him to found Elevate Society.

Tal Gur is an author, founder, and impact-driven entrepreneur at heart. After trading his daily grind for a life of his own daring design, he spent a decade pursuing 100 major life goals around the globe. His journey and most recent book, The Art of Fully Living, has led him to found Elevate Society.