Pursue Wealth Instead of Money

"Give me control of a nation's money and I care not who makes it's laws" - Mayer Amschel Bauer Rothschild

Money. We all use it. We all care about it. We all think about it.

The lack of money in our life can spark a range of emotions, from fear to frustration, to worry. We worry whether we have enough of it, or whether we spend too much of it. When the job market is poor, for example, or when the stock market crashes, we often get mad and blame the economy, or the government, or both.

What we hardly ever do about money, however, is ask ourselves where it comes from and who controls it.

Most people, if they consider it at all, think that money is created by the government; a myth, one of many, that will be addressed in this post.

For something so prominent in our life, like money, it is important that we don't blindly follow our beliefs, but instead study and understand them.

Only a few years ago, the whole financial system nearly collapsed. A previous colleague of mine lost half of his retirement savings during the height of the global financial crisis. He was a decent, hard-working man who, like many others, believed that hoarding money in a pension savings account will secure his financial future.

While the financial system seems to have stabilized since then, don't be fooled. It can happen again.

If you care about your financial future at all and want to dispel many of the myths around money, read on.

A Myth called Money

It would seem only natural that money is created by governments, but in reality, and contrary to the widespread assumption, money is created by banks.

In the United States for example, The Federal Reserve, which has the sole power to print the US Dollar, is privately owned bank with private shareholders who run it purely for private profit. Put differently, The Federal Reserve is not federal (nor does it hold reserves). In fact, it is as federal as Federal Express.

The story is not much different elsewhere in the world. The English, German, nor the French government owns any stock in the central bank of its country. Same as in the US, they are all privately held corporations.

Now, I know reading about central banks can bore you into a coma, but you really should give it a try. When you begin to understand how it all works, it will change your beliefs about money forever.

So here we go.

The illusion of paper money

The first point to note is that money is simply an idea. We live in an era where all paper currencies have no redemption or metallic value.

That has not always been the case. Up until 1971, paper currencies were backed by a percentage of their country's gold reserve, but that has changed with Nixon's decision to abandon the gold standard.

This historic decision meant that banks could now print money from thin air without the worry of having to back it with gold. And without any backing, the real value of your paper money is nothing but its purchasing power; something which can be dramatically changed in a short span of time.

Now, when a government needs money, it has to borrow it from their central banks, with interest of course. So, the government issues a bond, which is merely a promise to pay in the future, and gives it to the central bank. The bank, in return, creates the money from thin air and puts it into circulation.

In other words, all money is created out of debt. This means that if all outstanding debt was to be repaid today, there would not be even one dollar in circulation.

Where's the problem, you ask?

The problem and the inevitable consequence of all of this is bankruptcy.

Let me explain.

As interest is charged on all loans made by the central bank and as the money needed to pay back this interest does not exist in the money supply outright, the system creates an infinite debt growth.

To put it simply, if all debt was to be repaid today, not only would there not be even one dollar left in circulation, we would also stay with huge amount of debt that is literally impossible to pay, for the money to pay it back does not exist.

The other inevitable consequence of all of this is inflation.

In order to cover the interest charges and keep the system going, an everlasting increase of the money supply is needed. And when new money gets put into circulation, thus diluting the existing base of money, the general level of prices rises.

So, what's the big deal?

The more debt is created, the more expensive life becomes, the more people are ready to do anything for a job, and hence they become cheaper commodities for corporations.

If you're anything like the 99% of us on this planet exchanging freedom for money, you can identify with the above. It seems that everyone these days has debt of some sort.

Students in the US, for example, have to put themselves into a hole of debt in order to get their diploma. On average, medical students graduate with a debt load of more than US$100,000. No wonder health care costs in the US have skyrocketed and that Around 50 million people lack health insurance.

In fact, our entire society embraced debt, whether it is through overpriced home mortgages or credit card purchases, as a way to maintain our overspent lifestyle.

OK, But my personal situation is different, you say

Some of you who read this might be out of the debt cycle and even hold a large savings account, but unfortunately, you are still on the same boat. Nowadays, not only the average "Joe" is in mounds of debt, but also his country.

The economy of the US, for instance, long the world's dominant creditor, now the world's biggest debtor, is fighting a losing battle against trade imbalances that are growing daily. The current US national debt is a staggering and if you include unfunded liabilities such as Social Security, pension funds and Medicare, the real national debt exceeds US$50 trillion.

In Europe the picture is not different. Countries like Greece and Portugal have reached the brink of financial meltdown and the possibility of bankruptcy as a nation.

But the government says the economy is fine?

The ones we entrust to solve the problem, are the very same individuals who assured us the economy was OK in 2007, when the US real estate bubble burst and triggered a global credit crunch.

Perhaps it might be better to simply admit that most politicians just want to secure their re-election and therefore go with the easy fix of printing money instead of the painful choice of raising taxes.

In fact, and as there is no limit to the amount of money that central banks can create, governments around the world continue to inject massive amounts of money - in other words, taking further debt - to rescue their collapsing economies.

A natural question arises as to who is going to fund this extra loan.

You guessed it right - You, the devoted consumer and taxpayer.

This is done quite silently and over time via inflation - Since the amount of money in circulation increases, the money you earn or save looses part of its value. You can simply think of it as another form of tax.

You start to get the picture. If you rely on the government for your financial future, then you make a choice to accept the risk of potential monetary collapse and a lowered standard of living.

OK, OK, I get it. What can I do then?

The first essential step is to be aware that money is simply an idea backed by the collective faith of all us.

As Adam Smith, the father of modern economics, once wrote: "All money is a matter of belief." We've been conditioned from early age to think of money as the ultimate form of value but in itself, money does not hold very much of it. It only assumes its value during an actual exchange, something that is continuously re-evaluated in global markets.

It is time to stop pursuing money for its own sake and give up on working in environments where the singular goal is monetary gain. I had this mindset for years and it didn't serve me very well.

I was 22 when I decided to study computer science for my Bachelor's Degree. I did not make this choice because of my passion to the subject but mainly due to the fact that, at the time, computer science graduates earned the highest salaries in the market. In other words, I pursued money as an objective. I did it for the sake of money and nothing else.

I did complete my degree, but 3 years of dispassionate and monotonous study made me realize that I am following the wrong path in life. After exchanging my freedom for a steady pay check as a Software Project manager for a year and feeling unhappiness in every cell of my body I was finally convinced. It was time to make a dramatic shift.

So, what is the ultimate answer to financial security?

Instead of chasing money, strive to pursue wealth.

Although the two words are sometimes used interchangeably, they are different in meaning. Wealth is anything of real intrinsic value.

A business, for example, that adds value to others and makes you money in the process is wealth.

A real estate investment that generates cash flow and delivers ongoing net returns is wealth.

A financial portfolio that includes dividend-paying stocks, gold, and other assets is wealth.

And the list goes on.

Wealth is, therefore, the source of money. Money is the effect, rather than the cause, of wealth.

Now, wealth doesn't have to be bound to physical assets that hold monetary value but also intangible assets such as skills, experiences, ideas, knowledge, wisdom, creativity, health and relationships.

In fact, most of what I refer to as wealth is not reflected in the statistics by which economists normally evaluate performance.

The truth is, someone with very little money can be extremely wealthy. By holding a few of the intangible assets I described above, even a man who "loses it all" can flourish in his self made environment. In such a scenario, true friends will come to help and new ideas will permeate through naturally.

If you on the other hand, rely on your saving account to get you through rough times, you owe yourself the risk of inflation and perhaps hyperinflation. It has happened many times throughout history in almost every nation around the globe, including countries like Argentina, Brazil, China, Germany, Israel, Russia, Zimbabwe, and even twice in the US. You might well recall the expression "not worth a continental" which was the currency used before the introduction of dollar. History has a funny way of repeating itself.

I am not by any stretch a savvy investor, and I won't go in length here about specific investment vehicles, but I strongly encourage you to explore building REAL assets portfolios. Assets that grow in value over time and, as a result, can produce long-term financial security.

In my case, for example, It's an online business asset that provided me ongoing financial freedom, enjoyment, satisfaction and in addition allows me to make a living while traveling around the world.

Start Your 30-Day Online Business Challenge!

Most starting online entrepreneurs fail because:

- They overlook many of the key steps when planning their online business in the early stages.

- They take some action but fail to maintain the momentum and create the habits needed to grow their business.

- Or they get sidetracked and spend too much time on the wrong things.

That’s exactly where my 30-day online business challenge comes in.

If you’re ready to build a genuine online business platform that can lead to more income, time, and location freedom, then my challenge is for you.

Get it by pressing the big button below and start building your wealth.

More than anything, I am a firm believer that the most valuable investment you can make is an investing in yourself - your human capital. It's the stock of skills, knowledge, and experience you built throughout the years. It's the personal connections and relationships you've developed, both online and offline. And perhaps most importantly, it's the strength of personality and character - your internal qualities - that will give you the ability to generate income in any economy and any circumstance.

Final words

Countries, like people, have to live within their means or face the consequences of being indebted to a fraudulent economic system. We have been conditioned into supporting and maintaining this system for years. The government wants us to go back to the malls and use our credit for excessive consumption, but buying more stuff we don't really need, with money we don't really have was what got us into this predicament in the first place.

We've consumed so much yet we are devoid of what we really need. Now is the time to replace our current paradigm of money and, above all, instead invest in what truly matters.

To your Wealth!

Tal

P.S To start building real assets that grow in value over time, produce positive cash flow, and provide a safety net against inflation, check out my One Year to Freedom roadmap. It is geared towards generating multiple online income streams and diversifying your earnings.

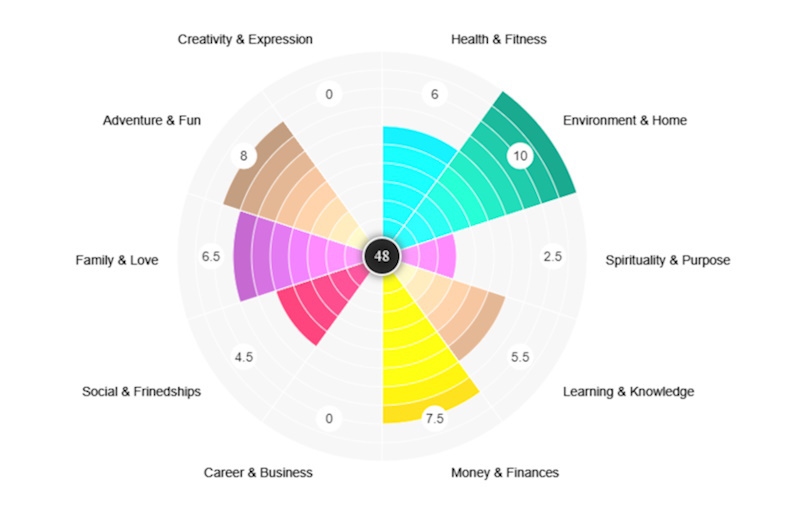

*To obtain more inspiration and motivation to achieve your goals, you definitely want to check out my extensive list of growth goals. This page contains SMART goal ideas that can help you establish new aspirations and attain greater heights in your personal growth journey. I utilized this page myself to create my own list of 100 life goals, which I dedicated a decade to pursuing.

Chief Editor

Tal Gur is an author, founder, and impact-driven entrepreneur at heart. After trading his daily grind for a life of his own daring design, he spent a decade pursuing 100 major life goals around the globe. His journey and most recent book, The Art of Fully Living, has led him to found Elevate Society.

Tal Gur is an author, founder, and impact-driven entrepreneur at heart. After trading his daily grind for a life of his own daring design, he spent a decade pursuing 100 major life goals around the globe. His journey and most recent book, The Art of Fully Living, has led him to found Elevate Society.