The Smartest Guys in the Room: Summary Review

This is a summary review of The Smartest Guys in the Room containing key details about the book.

What is The Smartest Guys in the Room About?

"The Smartest Guys in the Room" is a book that provides an in-depth look into the inner workings and ultimate downfall of energy company Enron through interviews and analysis of key players and events.

The Smartest Guys in the Room is not only about the Enron scandal, but also describes the authors' effort in following the developing story as it happened. It is based on hundreds of interviews and details from personal calendars, performance reviews, e-mails, and other documents. BusinessWeek called it, "The best book about the Enron debacle to date."

Summary Points & Takeaways from The Smartest Guys in the Room

Some key summary points and takeaways from the book includes:

* Enron was a highly influential energy company that was known for its innovative business strategies, creative accounting practices, and aggressive growth tactics.

* The company's success was built on a culture of risk-taking, deal-making, and aggressive accounting practices that allowed it to mask its financial problems and maintain an appearance of stability and growth.

* The key players at Enron, including CEO Kenneth Lay, CFO Andrew Fastow, and other executives, created a culture of greed and unethical behavior that led to the eventual collapse of the company.

* Despite its reputation as a forward-thinking company, Enron's management was plagued by a lack of transparency, a disregard for internal controls, and a failure to disclose important information to investors and employees.

* The Enron scandal was a wake-up call for regulators and the public, highlighting the need for greater accountability and transparency in corporate America.

* The book argues that the Enron scandal was not just a result of individual greed and unethical behavior, but was also a product of the broader economic and political context of the time, including the deregulatory policies of the 1990s and the financialization of the economy.

Who is the author of The Smartest Guys in the Room?

Bethany Lee McLean is an American journalist and contributing editor for Vanity Fair magazine. She is known for her writing on the Enron scandal and the 2008 financial crisis.

Peter Elkind is an award-winning investigative reporter and the author of The Death Shift. He has written for The New York Times Magazine, The Washington Post, Fortune, and Texas Monthly.

The Smartest Guys in the Room Summary Notes

The Rise and Fall of Enron: A Story of Deceit and Bankruptcy

The story of Enron is a cautionary tale about how even the most successful companies can come crashing down due to fraudulent practices and a lack of ethics. Enron started off as a promising energy company that quickly ran into financial trouble just two years after incorporating. The company was engaging in dishonest practices, particularly within the Enron Oil subdivision, which was speculating on oil prices and manipulating earnings. Despite these issues, Enron was trying to project an image of steady profitability to Wall Street investors. When the company faced financial ruin, CEO Ken Lay assured analysts that it was just a one-time event that would never happen again. Unfortunately, this kind of deceit and disregard for ethics was deeply ingrained in Enron's corporate culture, leading to its eventual downfall. The lesson here is that short-term gains achieved through dishonest practices can ultimately lead to long-term losses, as Enron's bankruptcy illustrates.

The Rise and Fall of Enron

Enron, a once-thriving energy company, was brought to its knees due to a combination of fraudulent business practices and an over-reliance on financial engineering. One of the main themes in the story of Enron is the role that visionary leadership played in shaping the company's trajectory. Jeffrey Skilling, a brilliant Harvard Business School graduate, transformed Enron from a company struggling to find a business model into a highly successful corporation - at least on the surface.

Skilling's first move was to turn Enron into a "Gas Bank," signing contracts with gas producers and customers and profiting from the difference. He also came up with the idea of trading these contracts, effectively turning Enron into a market maker. Secondly, Skilling pushed for the adoption of mark-to-market accounting, which allowed Enron to log the total estimated value of a contract on the day it was signed, making it appear to be growing quickly. Finally, Skilling emphasized hiring highly intelligent individuals with a variety of talents, even if they lacked management experience.

However, this reliance on financial engineering and an egotistical workforce eventually caught up with Enron. The company's success was built on a foundation of fraud, including the manipulation of earnings, the creation of fictitious companies, and the hiding of debt through off-balance sheet transactions. When the truth came out, Enron collapsed, and many of its executives faced legal consequences.

The story of Enron serves as a cautionary tale about the dangers of relying solely on financial engineering and visionary leadership, without sufficient checks and balances. It highlights the importance of ethical business practices, transparency, and accountability. Enron's downfall was a tragedy for the thousands of employees who lost their jobs and investors who lost their savings.

The Rise and Fall of Enron's Poster Child Rebecca Mark

Rebecca Mark was the face of Enron, responsible for striking energy deals with developing countries and making the company a global player. Her optimism and charming smile made her a star, but her subordinates were pushed to secure as many deals as possible, leading to a toxic deal-making culture. Enron's flawed compensation structure incentivized developers to close deals without any follow-through, resulting in disasters such as Enron's failed $95 million investment in a power plant in the Dominican Republic. Mark's leadership style and Enron's culture of greed and ambition played a significant role in the company's eventual downfall.

Enron's Shift to Trading and Culture of Risk-Taking and Deception under Jeff Skilling

Enron's transformation from a natural gas company to a trading powerhouse began with Jeff Skilling's appointment as President in 1996. Skilling immediately de-emphasized Enron's old businesses and made trading the company's central focus. With a goal of expanding into the electric power sector, Skilling shed profitable old operations to make room for new ones.

However, Skilling's tactics for generating Enron's annual earning targets were questionable. He would set fabricated numbers to reflect what Wall Street wanted, which created a culture of risk-taking and financial deceit. Trading desks could earn or lose millions in one deal, and Enron's Risk Assessment and Control department would only step in if a deal lacked commercial support. This led to deals coming with increasingly greater risks, but Enron could still present itself as a company that handled risk better than its competitors because of the RAC's existence.

To meet the earnings targets promised to investors, Enron resorted to overstating its future revenue to delay recording the losses it was taking. The company's flawed compensation structure also contributed to the toxic culture. Developers were paid bonuses for closing deals, but not for following through on them, leading to disasters like the Dominican Republic power plant that resulted in Enron's huge investment returning a mere $3.5 million.

Enron's Shift to Trading and Culture of Risk-Taking and Deception under Jeff Skilling

Enron's transformation from a natural gas company to a trading powerhouse began with Jeff Skilling's appointment as President in 1996. Skilling immediately de-emphasized Enron's old businesses and made trading the company's central focus. With a goal of expanding into the electric power sector, Skilling shed profitable old operations to make room for new ones.

However, Skilling's tactics for generating Enron's annual earning targets were questionable. He would set fabricated numbers to reflect what Wall Street wanted, which created a culture of risk-taking and financial deceit. Trading desks could earn or lose millions in one deal, and Enron's Risk Assessment and Control department would only step in if a deal lacked commercial support. This led to deals coming with increasingly greater risks, but Enron could still present itself as a company that handled risk better than its competitors because of the RAC's existence.

To meet the earnings targets promised to investors, Enron resorted to overstating its future revenue to delay recording the losses it was taking. The company's flawed compensation structure also contributed to the toxic culture. Developers were paid bonuses for closing deals, but not for following through on them, leading to disasters like the Dominican Republic power plant that resulted in Enron's huge investment returning a mere $3.5 million.

Enron’s Financial Disguises: The Role of Andrew Fastow

One of the main themes here is the role of Enron’s CFO, Andrew Fastow, in creating the financial structures that allowed the company to disguise its debt and present a false image of its financial health. Fastow and his team created subsidiaries like Whitewing that purchased and sold off poorly performing assets at inflated prices, allowing Enron to disguise losses as profits. Fastow also created a fund called LJM that invested in Enron’s failing stocks and kept them off the balance sheets. While these schemes allowed Enron to present a rosy picture to the world, they were unsustainable, and eventually led to the company’s downfall. Fastow’s dual positions as both CFO of Enron and head of LJM created a conflict of interest that enabled him to personally profit from these schemes, making tens of millions of dollars. Fastow’s actions, along with those of other executives at Enron, illustrate the dangers of unchecked greed and the consequences of a corporate culture that values deception and risk-taking over integrity and honesty.

Enron’s Failed Ventures into Electrical Energy and Broadband

Enron’s fraudulent accounting practices were unsustainable, and Jeff Skilling believed that the future of Enron lay in electrical energy and broadband. However, both of these ventures turned out to be colossal failures. Skilling’s first plan was to enter the electrical energy business and take advantage of the expected deregulation of the industry. However, local energy providers fiercely opposed deregulation, and Enron could only sell power directly to customers in a few states. In California, where Enron could sell power directly, they spent over $20 million on advertising to bring in new business, but customers preferred to stick with their reliable utility companies, and Enron did not have the necessary expertise to improve efficiency.

Skilling’s second plan was to enter the broadband industry and trade bandwidth capacity, just like they traded natural gas. Enron promised to deliver real-time bandwidth-on-demand by building a new broadband network system. However, their system was not operational on a commercial scale, and much of the promised technology never made it out of the lab. Enron was simply not capable of providing bandwidth-on-demand.

The failure of these ventures revealed a critical flaw in Enron’s business strategy. The company had relied on fraudulent accounting practices to create the illusion of profitability, but it did not have a solid foundation of real profits. Instead of developing expertise in industries where they could have a competitive advantage, Enron pursued ventures without a clear understanding of how to succeed. The failures of Skilling’s plans showed that Enron was unable to adapt to changing circumstances and lacked the necessary expertise to compete in the industries it entered.

Analysts knew Enron was hiding its debt but still loved the company.

Enron's rapid rise to success can be attributed to the unwavering support of financial analysts who praised the company's performance and growth, despite knowing that Enron was hiding its debt. The company's annual analysts meeting in 2000, where Enron unveiled its new broadband strategy, was a perfect example of this. Not a single analyst asked a probing question or showed skepticism towards Enron's predicted success. Instead, they rushed to invest in Enron, resulting in the company's stock price rising by 26 percentage points in just one day.

Even though some analysts knew that Enron's recorded earnings were well beyond the actual money coming in, they still praised the company's performance. They also knew that Enron had a large amount of off-balance-sheet debt, but only occasionally mentioned it in their reports. This shows that the analysts' blind faith in Enron's performance blinded them from critically analyzing the company's financial situation.

This unwavering support from analysts and investors allowed Enron to continue with its fraudulent accounting practices for an extended period, leading to the eventual downfall of the company. The case of Enron highlights the need for financial analysts to critically analyze a company's financial situation and not rely solely on reported earnings and predictions. It also highlights the importance of regulatory bodies to ensure that companies operate within ethical and legal boundaries, preventing fraudulent activities and protecting investors.

Enron’s Financial Troubles Uncovered in 2000

In 2000, skepticism about Enron's financial state began to emerge. Jonathan Weil's book on energy traders' reliance on mark-to-market accounting brought attention to Enron's accounting practices. Hedge fund manager Jim Chanos began investigating further and discovered that Enron was reporting increasing earnings, but the business itself didn't seem to be making much money. Fortune magazine published an book titled "Is Enron Overpriced?" which questioned the company's lack of cash flow and rising debt.

Enron's troubles continued when CEO Jeff Skilling unexpectedly resigned just six months into the job, and Ken Lay returned to fill the role. Skilling's resignation raised speculation about potential troubles at Enron. Despite the mounting concerns, Enron's stock continued to rise, and analysts remained blindly faithful to the company's performance. Many analysts knew Enron was hiding debt and overstating earnings, but they didn't question the company's practices.

The theme of Enron's downfall is a cautionary tale about the dangers of greed, corruption, and blind faith in corporate leaders. Despite the warning signs, Enron's executives and analysts continued to fuel the company's rise until its eventual collapse. The Enron scandal highlights the importance of transparency, ethical leadership, and accountability in corporate America. It serves as a reminder that companies must prioritize honesty and integrity over short-term profits and personal gain.

Enron’s downfall and bankruptcy due to massive debt and accounting scandals

Enron’s collapse was inevitable due to the massive debt and accounting scandals that had been plaguing the company for years. Despite the company’s seemingly successful growth in the late 1990s, Enron was relying heavily on creative accounting methods, such as mark-to-market accounting, to inflate its profits and hide its massive debt. These concerns began to surface in 2000, and despite Skilling’s promotion to CEO, skepticism about Enron’s success only continued to grow.

Enron’s stock price plummeted, dropping from a peak of $90 per share to below $20 per share in October 2001. The company was facing a cash crisis as a result of its plummeting stock price and credit rating, and Enron’s executives were in dire need of two or three billion dollars to avoid bankruptcy. But even that was out of the question, as Enron’s line of credit was bone dry.

Enron’s only hope to avoid bankruptcy was to merge with Dynegy, but the deal ultimately failed due to the doubts of Wall Street traders and the executives at Dynegy. With no other options left, Enron filed for bankruptcy on December 2nd, 2001, which was the biggest bankruptcy case in the history of the United States.

Enron’s collapse ultimately revealed the devastating consequences of corporate greed and unethical behavior, and it resulted in the loss of thousands of jobs and billions of dollars in investor value. The scandal also led to the enactment of stricter accounting and financial regulations, such as the Sarbanes-Oxley Act, to prevent similar scandals from happening in the future.

Enron Executives Face Justice

Enron's executives, including Ken Lay, Jeffrey Skilling, and Andrew Fastow, were found guilty of fraud and sentenced to prison after the company's collapse in 2001. The collapse was due to Enron's massive debt and plummeting stock, which resulted in the company being unable to pay its creditors. Despite their initial denial of responsibility, the executives were indicted by the United States Department of Justice, with 33 people being indicted, and 25 former Enron executives charged.

Andrew Fastow pled guilty to all charges and served six years in prison, admitting that he and other members of Enron's senior management fraudulently manipulated Enron's publicly reported financial results. Ken Lay was found guilty on all counts, but passed away before sentencing. Jeffrey Skilling was indicted on 35 counts, found guilty on 19 of them, and sentenced to over 24 years in prison and a $45 million fine.

Rebecca Mark, who left Enron in August 2000 before the scandal was made public, was never accused of any crimes. However, she sold her Enron stock at its peak, earning $82.5 million.

The Enron scandal highlights the importance of ethics and responsibility in business. The executives' fraudulent actions led to the company's downfall, affecting not only the shareholders but also the employees who lost their jobs and retirement savings. Enron's collapse resulted in increased scrutiny of corporate governance and accounting practices, leading to new regulations such as the Sarbanes-Oxley Act of 2002.

The Enron scandal serves as a warning to businesses that prioritize profit over ethics and integrity. It is essential to establish a culture of transparency and accountability to ensure that fraudulent behavior is not tolerated. The consequences of fraudulent behavior can be severe, not only for the individuals involved but also for the entire organization and its stakeholders.

Book Details

- Print length: 480 pages

- Genre: Business, Nonfiction, Finance

The Smartest Guys in the Room Chapters

Chapter 1:Lunch on a Silver Platter

Chapter 2:Please Keep Making Us Millions

Chapter 3:We Were the Apostles

Chapter 4:The First Prima Donna

Chapter 5:Guys with Spikes

Chapter 6:The Empress of Energy

Chapter 7:The 15 Percent Solution

Chapter 8:A Recipe for Disaster

Chapter 9:The Klieg-Light Syndrome

Chapter 10:The Hotel Kenneth-Lay-a

Chapter 11:Andy Fastow's Secrets

Chapter 12:The Big Enchilada

Chapter 13:An Unnatural Act

Chapter 14:The Beating Heart of Enron

Chapter 15:Everybody Loves Enron

Chapter 16:When Pigs Could Fly

Chapter 17:Gaming California

Chapter 18:Bandwidth Hog

Chapter 19:Ask Why, Asshole

Chapter 20:I Want to Resign

Chapter 21:The $45 Million Question

Chapter 22:We Have No Cash!

What is a good quote from The Smartest Guys in the Room?

Top Quote: “Never, ever do the easy wrong instead of the harder right.” - The Smartest Guys in the Room Quotes, Bethany Mclean and Peter Elkind

What do critics say?

Here's what one of the prominent reviewers had to say about the book: “The authors write with power and finesse. Their prose is effortless, like a sprinter floating down the track.” — USA Today

* The editor of this summary review made every effort to maintain information accuracy, including any published quotes, chapters, or takeaways. If you're interested in furthering your personal growth, you may want to explore my list of favorite self-improvement books. These books, which have had a significant impact on my life, are carefully curated and come with summaries and key lessons.

Chief Editor

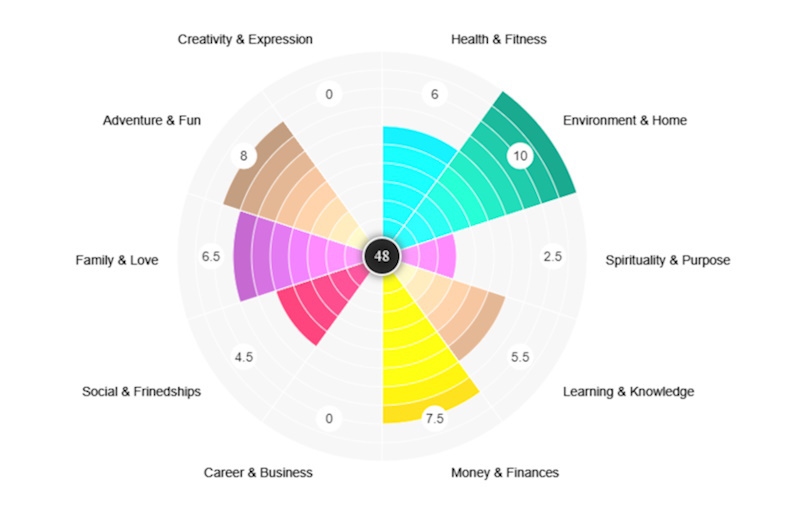

Tal Gur is an author, founder, and impact-driven entrepreneur at heart. After trading his daily grind for a life of his own daring design, he spent a decade pursuing 100 major life goals around the globe. His journey and most recent book, The Art of Fully Living, has led him to found Elevate Society.

Tal Gur is an author, founder, and impact-driven entrepreneur at heart. After trading his daily grind for a life of his own daring design, he spent a decade pursuing 100 major life goals around the globe. His journey and most recent book, The Art of Fully Living, has led him to found Elevate Society.